8915 e form tax act

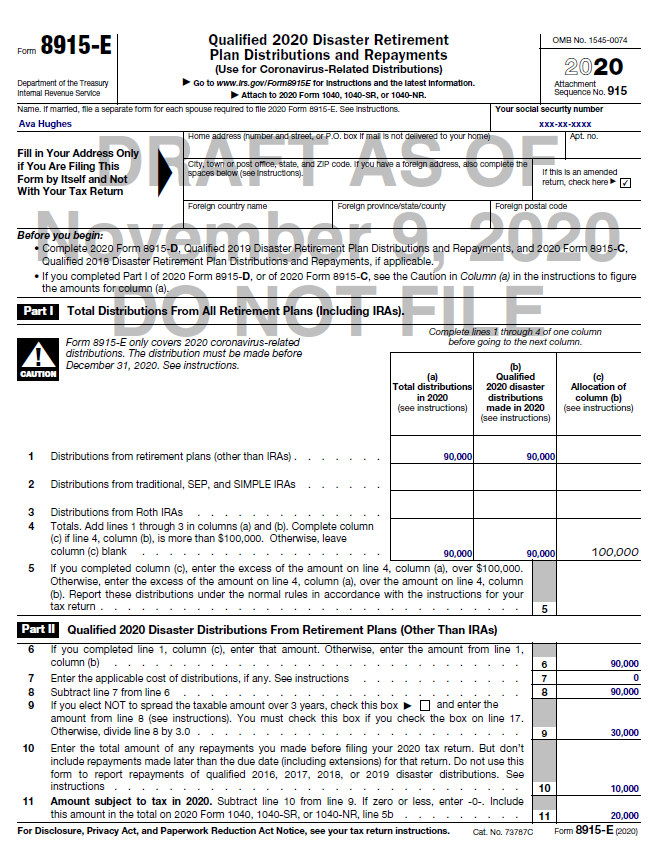

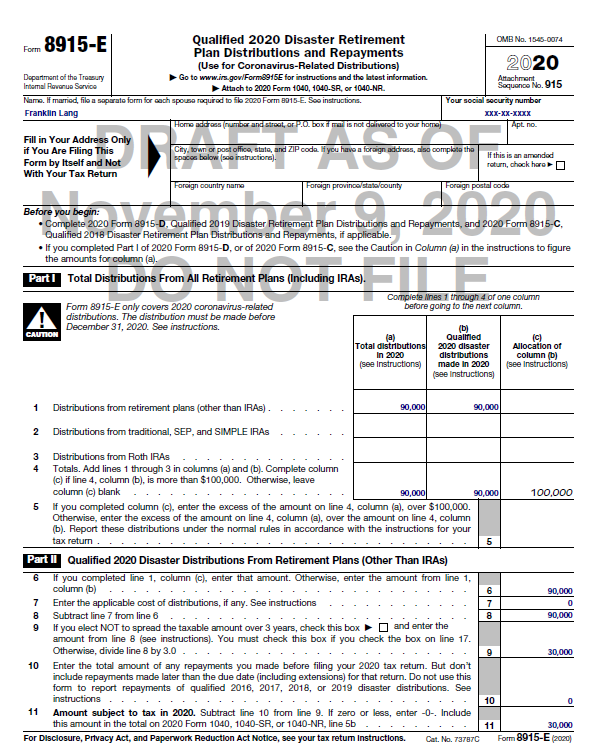

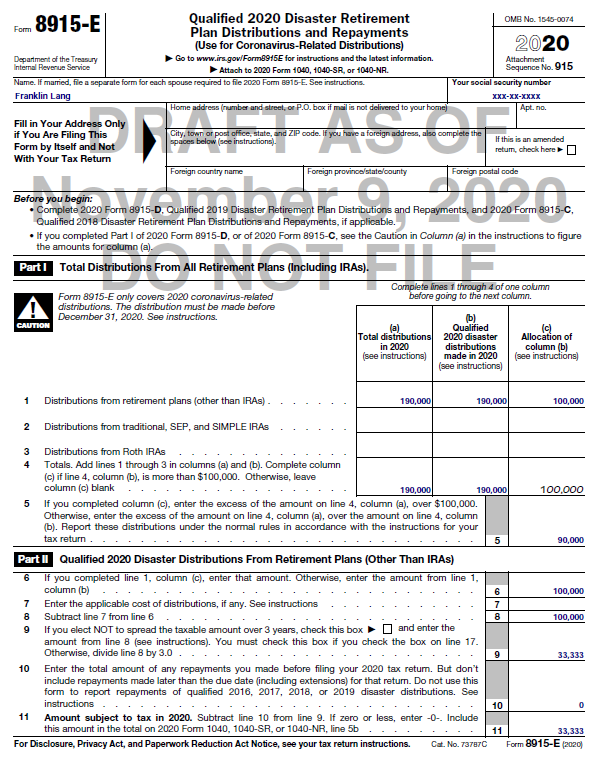

Form 8915-E 2020 Qualified 2020 Disaster Retirement Plan Distributions and Repayments Department of the Treasury Internal Revenue Service Use for Coronavirus-Related and Other. Only the early withdrawal 10 penalty will be.

Irs Releases Faqs On Coronavirus Related Retirement Plan Changes Found In The Cares Act

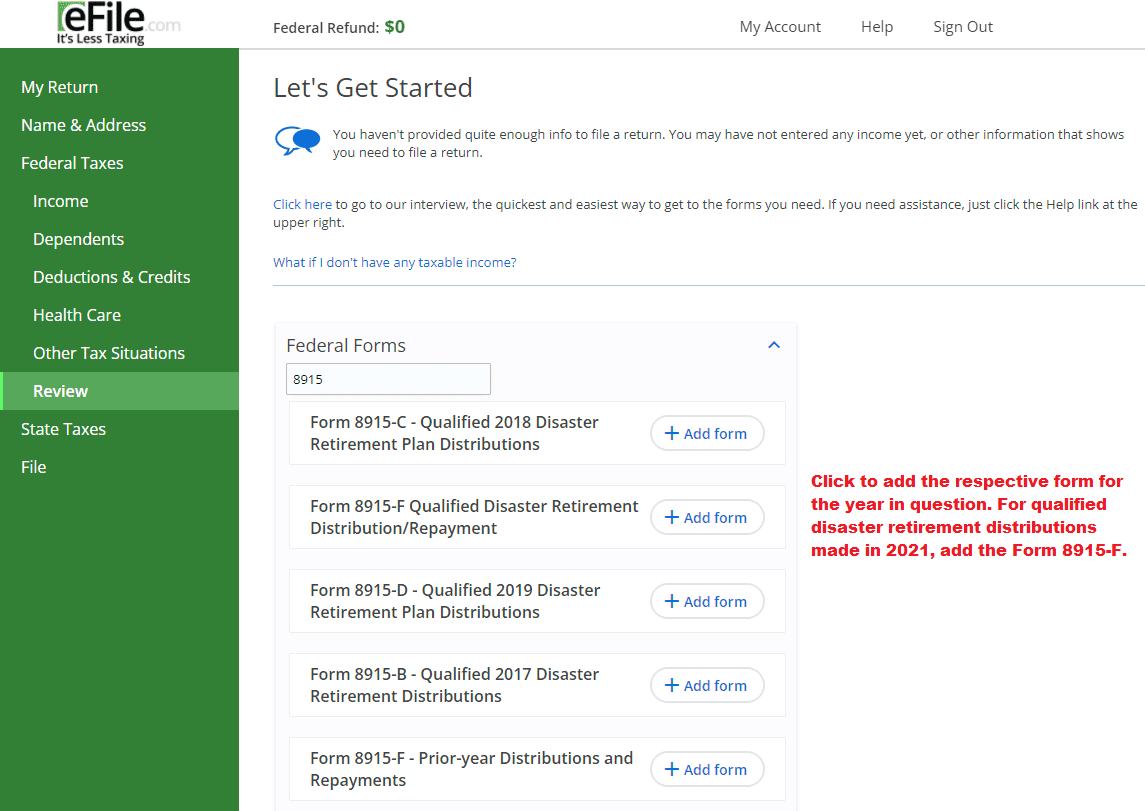

From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your screen then click Federal.

. It should walk you through the questionnaire. Congress enacted relief to ease the financial burden of those incurring disaster losses or have suffered financially due to the Coronavirus. Solved Re Form 8915-e Is Available Today From Irs When - Page 2.

The form is on TaxAct my return has it. Click the Retirement Plan Income dropdown. How To Pay Taxes Over 3 Years On Cares Act.

Re When Will Form 8915-e 2020 Be Available In Tur - Page 19. Form 8915-E will allow you to pay tax on one third of the distribution over the next three tax years. The CARES Act states that the additional 10 tax does not apply to any coronavirus-related distribution up to 100000 Act Sect.

Make sure you enter the 1099-R and check the box on that screen that it was due to a qualified disaster. From within your TaxAct return Online or Desktop click Federal. Purpose of Form Use Form 8915-E if you were impacted by a qualified 2020 disaster including the coronavirus and you received a distribution described in Qualified.

On smaller devices click in the upper. Yes you can amend to file 8915-E to avoid the 10 penalty and to allow the repayment within 3 years. March 16 2021 628 AM Form 8915-E will be completed automatically based on how the interview for Form 1099-R is completed.

With those relief measures the IRS. However be aware that if the taxpayer repays the amount you may. Entering in Program - Form 8915-E To enter or review Form 8915-E information.

You can use the steps below to make sure you have chosen the right steps to.

Coronavirus Related Distributions Via Form 8915

National Association Of Tax Professionals Blog

Use Form 8915 E To Report Repay Covid Related Retirement Account Distributions Don T Mess With Taxes

National Association Of Tax Professionals Blog

Exhaustion Of Administrative Remedies Not Required Where Administrator Failed To Provide Timely Benefit Determination On Review

Irs Forms Publications Trout Cpa

What Clients Won T See On This Year S 1099 R Form Investmentnews

Coronavirus Distributions Adverse Financial Consequences And Recontributions Wolters Kluwer

National Association Of Tax Professionals Blog

Forgot To Reverse Withdrawal From Retirement Account Here S How To Fix It

Irs Increases Eligibility For Covid 19 Related Retirement Plan Withdrawals Doeren Mayhew Cpas

Top Irs Audit Triggers Bloomberg Tax

Cares Act Retirement Distributions Reporting Form 8915 F 2021 From 2020 Irs Form 8915 E Youtube

What You Need To Know About Coronavirus Related Distributions Before Filing Your 2020 Tax Return

Irs Releases Clarifying Faqs On Cares Act Retirement Plan Relief

Cares Act Retirement Plan Provisions With Updates As Of July 2020 Tri Ad

Reminder Due Dates For 2020 Tax Returns And The Change Of Tax Day To May 17th Wegner Cpas